It's described as the worst fraud in U.S. history. For months, KCRA 3 Investigates producer Dave Manoucheri and Photographer Victor Nieto traveled across California and interviewed people in other states as part of an unprecedented documentary project that revealed a wave of failures at California's Employment Development Department, or EDD.With more than 20 hours of interviews and dozens of hours of news footage — Easy Money tells the story of outrageous abuses of the unemployment benefits system.(Important for our KCRA app, Google and Facebook users: Click HERE for the best mobile experience).The first four chapters of the documentary aired on Dec. 12, 2021, and can be watched below (you can watch the full version by clicking here). On May 11, 2022, we aired two new chapters. "Easy Money: The New Wave" details disability fraud. Those chapters have also been added below. Skip to Chapter 2Skip to Chapter 3Skip to Chapter 4Skip to Chapter 5Skip to Chapter 6(App users, click here if you want to skip chapters.)We encourage you to scroll as you go. You'll find a timeline of EDD's problems , an interactive quiz that might surprise you about how the fraud operated, examples of other things you could fund with $20 billion from stolen taxpayer money and resources for how to protect your identity. Chapter 1: The Check’s in the Mail Fresno realtor Don Scordino was used to arriving at vacant homes and occasionally putting packages inside that a mail carrier dropped off. Usually, the names match up with the owner. That changed during the COVID-19 pandemic. One home in southeast Fresno received 67 letters from EDD that listed 10 different names. Another home further south in Beverly Hills had 35 names. Antelope Valley Assemblymember Tom Lackey began getting letters as early as March of 2020. He even tried to bring them to the EDD offices and was turned away, saying he couldn’t come into the building. He eventually brought one month’s worth to a legislative oversight hearing. They filled an entire suitcase.Detective Brian Money with Riverside police said he started getting multiple calls from people there saying they received EDD mail at their homes, too. "We had constituents who said, 'Hey, I got 10 letters not addressed to me. What do I do?'" said David Chiu, a former Assemblymember representing San Francisco. "And we tried to reach out to EDD. Didn't get a response, or we heard that EDD was telling folks to just get rid of the letters or to mail them back to EDD – just answers that didn't make any sense to us."Some homeowners told police that others had shown up at their homes to demand the mail. Burglaries of homes and robberies of postal inspectors over EDD envelopes followed. In this chapter of Easy Money How we got here: Stories of gridlock and confusion after California closed businesses in March 2020 and sent unemployment numbers soaring. EDD's systems crashed and people needing unemployment relief couldn't get answers about their delays. Police and lawmakers hear about letters from EDD sent to bogus addresses and face challenges getting answers from EDD.How Gov. Gavin Newsom reacts to early reports of widescale fraud.The brazen steps criminals take, including making a rap video showing how easy it is to get money from EDD.Watch Chapter 1 below: A timeline of EDD's growing backlog and dysfunctionSome of EDD's problems predate the unprecedented COVID-19 pandemic and went unaddressed after previous audits, dating all the way back to at least 2008. After March 2020, a backlog of unemployment claims dovetailed with a rise in fraudulent claims. See KCRA 3's coverage of a series of missteps month by month in a timeline below. Chapter 2: How the PUA Crime UnfoldsCybersecurity expert Parker Crucq says that whenever there’s a big event happening in the world “we can expect criminals to capitalize on that event.” In April 2020, California launched a new website for people to apply for pandemic unemployment assistance (PUA), allowing those who were self-employed or independent contractors to get assistance. Tutorials began to pop up on the dark web on how to file a fraudulent PUA claim through a state’s unemployment website.Click the slideshow below for an illustration of the basic EDD fraud scheme.To make getting unemployment relief faster for those needing benefits, the state of California contracted with Bank of America to provide EDD debit cards. But those cards lacked anti-fraud chip technology or limits on how much cash could be withdrawn at once.PUA fraud became so easy it became its own search term on criminal message boards.Soon, surveillance video in Torrance would capture people feeding card after card into ATM machines at the town's two main banks.District attorneys across California formed an EDD task force to investigate reports of fraud. It uncovered that people incarcerated at every prison and jail in California were collecting unemployment. At one jail in El Dorado County, half of the people incarcerated there were collecting benefits, District Attorney Vern Pierson said. Sacramento County District Attorney Anne Marie Schubert was shocked to see claims taken out under the names of "Minnie Mouse" and "Poopy Britches." Convicted killers Scott Peterson and Cary Stayner had claims taken out in their names, too.Back in Southern California, 44 people were arrested with envelopes and debit cards in a September 2020 Beverly Hills fraud bust. In Torrance, detectives needed a U-Haul truck to hold a refrigerator, washer and dryer, laptops, tablets and more gear recovered from one suspect (see pictures of what was recovered in the gallery below). Some new customers flush with cash rented flashy cars to hit up Rodeo Drive for Gucci bags and $125 slippers imported from Paris."The traffic was insane," recalled Kitson boutique owner Fraser Ross. "The rentals were hot. You could see more Rolls Royces in LA all of a sudden." "The bad guys knew about it. It's easy money," said Elk Grove Assemblymember Jim Cooper. "I'm not robbing a bank or robbing a store. I'm not stealing drugs. This is white-collar crime."Police would go on to make arrests of accused EDD fraud ring leaders up and down the state.Meanwhile, police departments and DAs started seeing what they call a "concerning" trend where EDD money was being used to fund drugs, ghost guns and human trafficking.At a tense oversight hearing in October 2020, Southern California Assemblymember Rudy Salas asked then EDD Director Sharon Hilliard if she knew how much taxpayer money had been lost to widespread unemployment fraud. "No, that's not something that we track," Hilliard said. Assemblymember Chiu told Hilliard criminal rings were "stealing tens of thousands of people's identities" and her department had been "silent." "You're saying you don't want to tell fraudsters how to do their job but they're already doing their job," he said. "But you're not warning the public on the level of fraud. You're giving no details on the types of crimes being committed against people so that people can be aware of what to look out for."On Oct. 30, 2020, Hilliard announced her retirement. She left her post as director on Dec. 31, 2020, and was replaced by Rita Saenz.In this chapter of Easy Money: A cybersecurity expert shows how stolen identities are bought and sold on the dark web. An LA boutique owner describes seeing people with wads of cash and cards hit up stores like they'd "just won the lottery."Hear jail conversations about how easy it was to get fraudulent claims. State lawmakers ask why EDD isn't sounding the alarm on fraud and call for an emergency audit.Watch Chapter 2 below: Think you have a handle on how EDD fraud works now? Take this interactive quiz. The answers might surprise you.(App users, click here to take an interactive quiz about how EDD fraud works)Chapter 3: A Cascade of ErrorsAssemblymember Patterson jokes that nothing moves bureaucracies faster than having Elaine Howle down their back.Howle has served for two decades as California's auditor, providing oversight of state agencies. In September 2020, 40 members of California's Assembly and seven state senators signed on to an emergency audit request of EDD.It wasn't the first time Howle would pinpoint problems for EDD to fix. Problems flagged by her office date back to 2008. In 2011, her report found issues with EDD's call center operations. A follow-up the next year "identified the same problems."Howle's office decided on two separate audits this time, one dealing with concerns about people having difficulties with their claims and another dealing with identity theft and fraud. | RELATED | Read the state auditor's two January 2021 reports with recommendations for EDD hereHowle found that in April and May of 2020 the federal government had sent out a warning about the need "to keep certain controls in place.""So you would think you would have put a lot of resources on that and really thought through and worked with the federal government," Howle said. "OK, here are the requirements for the program. What are the kinds of controls we can or should put in place to try to mitigate fraud as much as we possibly can?"Back in 2013, EDD had received a federal grant for new fraud-detection software by a Gold River company called Pondera Systems. The program compares public databases to see if applications are true or fraudulent. One former EDD employee told KCRA 3 Investigates it detected "an amazing amount of fraud."But by the summer of 2016, EDD decided not to pay the roughly $2 million a year to continue using the system after the grant funding ran out and EDD shut the Pondera system off.Howle pointed to another misstep over crossmatching unemployment claims with the names of incarcerated people across the state. EDD had told the Legislature long before the pandemic about its plan to cross-check fraud but "never got around to accomplishing it," she said.Meanwhile, victims of identity fraud began to receive tax forms for income they never received. Modesto Rep. Josh Harder said his office worked to help 3,500 people facing the issue. "The IRS needs a list of who actually legitimately got EDD benefits," he said. In this chapter of Easy Money:Learn about the fraud-catching system that EDD abandoned.Auditor Howle talks about EDD's history of problems and says that unemployment fraud across the country is "the most significant fraud occurrence that has happened for the United States." Identity theft victims begin to receive tax bills for money they never received. EDD's new director, Rita Saenz, agrees that people should be "pissed off" over her agency's screw-ups.Watch Chapter 3 below:What could you buy with $20 billion? Here's a startUnemployed Californians struggled to get money for legitimate claims, all while the EDD paid out more than $20 billion to fraudulent accounts. Here's what you could buy with all that money. Chapter 4: The AftermathIn late July 2020, former federal prosecutor McGregor Scott was hired by the governor's office and EDD to help solve the agency's problems. Scott is not an employee. He has a unique position as an "independent counsel" as part of a Sacramento law firm."Grifters and fraudsters are out there looking for any weakness," he said. "And unfortunately, they identified a lot of weaknesses in the EDD process in terms of distributing money, and they took full advantage."New safeguards like ID.me, an identity verification system used by other government agencies, have helped to stop fraud from taking place, he said. In an irony, EDD hired the same company whose software they shut off – Pondera Solutions, now owned by Thomson Reuters – to partially help with fraud monitoring.Another issue Scott said he's worked to address is EDD's delays in processing search warrants and other requests from law enforcement.Riverside Det. Money said that EDD was taking several months to deliver records that would help him crack down on fraud. EDD has since created a memorandum of understanding that a law enforcement agency can sign with EDD to go directly to the agency for needed documents.Still, investigators and district attorneys say the EDD debacle has consumed their resources. In Sacramento County, a person working full-time on EDD fraud could "spend the rest of their career probably doing these cases," District Attorney Schubert said. Law enforcement investigators said they spent 85% of their time working EDD cases at the expense of other crimes.At the Capitol, lawmakers passed a sweeping set of bills to change EDD's practices. Of the 10 bills written in that legislative session, four would make it into law. In October 2021, Newsom signed into law a requirement that California's prison system share information with EDD to cross-check for claims and that EDD help identity theft victims.| RELATED | See an update from Auditor Howle from Oct. 25, 2021, that grades EDD on how well the agency has complied with her recommendations. At a hearing earlier in the year, EDD's Saenz was asked how many people were fired for substandard job performance since she became director. Saenz said she didn't know but added, "I don't have any sense that it's an unusual amount." "I mean, we're talking 12 years in one instance, with the recommendations from the auditor, they ignored that this is going to help you and help your department and then you ignore it," Assemblymember Cooper said. "And it just didn't sit well with me. It doesn't sit well today, and it shouldn't with the citizens." In this chapter of Easy Money: Former federal prosecutor McGregor Scott is brought in to fix problems at EDD and talks about his role and progress that's been made. How identity thieves skim information off EDD cards' magnetic strips. Why asset forfeiture law makes it hard to recover cash and goods bought with fraudulent EDD money.The estimates of the total fraud come into focus — and why the true cost is so hard to trace. Is there hope that EDD will be reformed?Watch Chapter 4 below:Chapter 5: The New WaveMike Holm was in the hospital for nearly a month and spent another month in a nursing care facility after getting a diabetic ulcer on his foot.The junior varsity football coach at Whitney High School in Rocklin had gone on disability like hundreds of thousands of other Californians. It started well."I ended up receiving four checks," Holm said. "Then everything was just cut off."He was caught in what Sacramento County District Attorney Schubert called “a new wave of EDD fraud.”“The thievery will never go away. They're just going to try to change it up,” Schubert said.In January 2022, EDD suspended 345,000 disability claims as the agency worked to verify the identity of about 27,000 doctors whose credentials were used to file the claims for purported patients.Holm and others with disabilities called EDD to try to unfreeze their claims. When that didn’t work they emailed their elected representatives and in some cases waited in line for hours outside EDD offices.In this chapter of Easy Money:Offices of lawmakers are inundated with calls from people with legitimate claims who are cut off.People travel to EDD offices that are far from home and still have trouble getting answers.Like the first wave of pandemic fraud that hit EDD, letters begin to show up in more mailboxes in the names of people who never filed claims.Watch Chapter 5 below: Chapter 6: The Middle AgesAs EDD grappled with the new wave of disability fraud, Director Saenz was moving on.Gov. Newsom announced in January 2022 that Saenz was out and Nancy Farias, a chief deputy director, would become EDD’s third director since the pandemic began.Meanwhile, EDD officials say at a budget hearing that the fraud unit recommended by the state’s auditor is “fully staffed and operational.”“They had like a dozen peace officers to cover the whole state of California 40 million people,” Assemblymember Cooper says. “So really, the folks that have done the most in this, EDD fraud have been local law enforcement, your deputy sheriffs and police officers have done most of the investigations, most of the search warrants.”One of the issues law enforcement has faced is a difficulty in seizing assets bought from fraudulent accounts. Under California law, it's harder to take the materials unless it’s that it was bought with illegally obtained money.After the first four chapters of our “Easy Money” documentary were released, Cooper announces on a KCRA Facebook Live that he’ll introduce a new bill to allow law enforcement to seize those assets. But he’s skeptical that it will advance out of committee.Another lawmaker, Assemblymember Patterson, thinks that he and other lawmakers who have sounded the alarm on EDD fraud have been having an effect.“Those of us who have been elected to represent the constituents that are supposed to be served by the EDD, we have forced them to try at least to do a better job,” he said. “And maybe we're coming out of the dark ages of the EDD and maybe into the middle ages of the of the EDD. I don't know.”In this chapter of Easy Money:EDD’s latest director takes the helm as the agency works to implement recommendations from the state auditor.Assemblymember Cooper introduces a new bill to change asset forfeiture law. But will the bill advance out of committee?Watch Chapter 6 below: Gov. Newsom responds to KCRA 3's questions about EDD fraudSince the summer of 2021, KCRA 3 has asked Gov. Gavin Newsom to go on camera to talk about the massive fraud that hit EDD. With no response from the governor, "Easy Money" producer Dave Manoucheri attended the announcement of the state's revised budget in May 2022. See the governor's responses to some of the questions raised in the documentary here. Moving forward: How to protect yourself from fraudOne of the most common ways criminals were able to take information from EDD debit cards was through a technology that has been around for quite some time: card skimmers.Card skimmers are normally used at places like gas stations, which see several customers over short periods of time. See how they work in the video below. Before you put your card in at gas stations — where card skimmers are most common — make sure the gas pump panel shows no signs of tampering. Then take a good look at the card reader itself, making sure it looks normal. If something seems off, wiggle the card reader and if it moves, let the attendant know.When possible, run debit cards as credit so you don't have to put in a PIN. If this can't be avoided, cover your PIN with your hand so possible cameras nearby can't see what numbers are being typed in.Never leave your credit or debit card out of sight either, and only take it out when you're about to use it.Experts say that people should also keep any electronics like phones, tablets and computers up to date with the latest software updates to help protect against any vulnerabilities.Also, familiarize yourself with the red flags that accompany scams. Be wary of emails, text messages, phone calls and letters from people you do not know. More importantly, never send money — whether it be cash, check or gift cards — to strangers or anyone pressuring you to send funds. This digital presentation was written and produced by Hilda Flores and Daniel Macht.

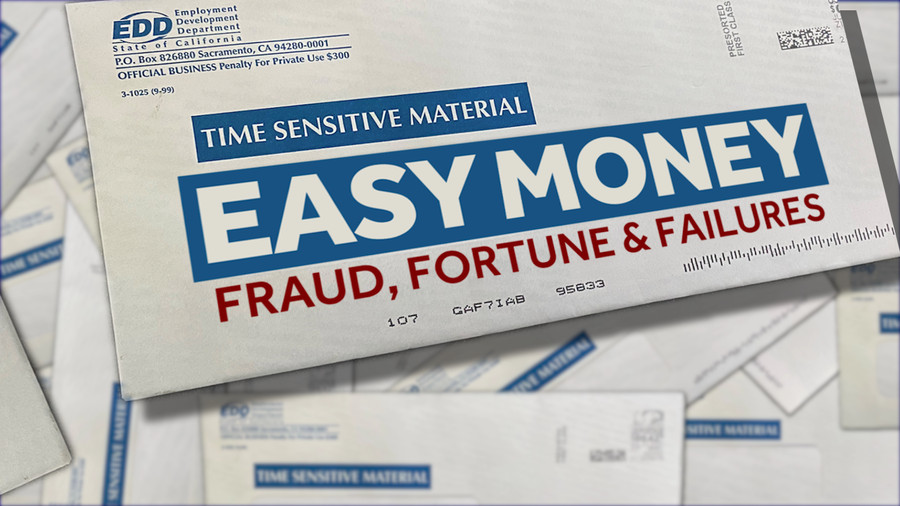

It's described as the worst fraud in U.S. history. For months, KCRA 3 Investigates producer Dave Manoucheri and Photographer Victor Nieto traveled across California and interviewed people in other states as part of an unprecedented documentary project that revealed a wave of failures at California's Employment Development Department, or EDD.

With more than 20 hours of interviews and dozens of hours of news footage — Easy Money tells the story of outrageous abuses of the unemployment benefits system.

(Important for our KCRA app, Google and Facebook users: Click HERE for the best mobile experience).

The first four chapters of the documentary aired on Dec. 12, 2021, and can be watched below (you can watch the full version by clicking here). On May 11, 2022, we aired two new chapters. "Easy Money: The New Wave" details disability fraud. Those chapters have also been added below.

Skip to Chapter 2

Skip to Chapter 3

Skip to Chapter 4

Skip to Chapter 5

Skip to Chapter 6

(App users, click here if you want to skip chapters.)

We encourage you to scroll as you go. You'll find a timeline of EDD's problems , an interactive quiz that might surprise you about how the fraud operated, examples of other things you could fund with $20 billion from stolen taxpayer money and resources for how to protect your identity.

Chapter 1: The Check’s in the Mail

Fresno realtor Don Scordino was used to arriving at vacant homes and occasionally putting packages inside that a mail carrier dropped off. Usually, the names match up with the owner. That changed during the COVID-19 pandemic.

One home in southeast Fresno received 67 letters from EDD that listed 10 different names. Another home further south in Beverly Hills had 35 names.

Antelope Valley Assemblymember Tom Lackey began getting letters as early as March of 2020. He even tried to bring them to the EDD offices and was turned away, saying he couldn’t come into the building. He eventually brought one month’s worth to a legislative oversight hearing. They filled an entire suitcase.

Detective Brian Money with Riverside police said he started getting multiple calls from people there saying they received EDD mail at their homes, too.

"We had constituents who said, 'Hey, I got 10 letters not addressed to me. What do I do?'" said David Chiu, a former Assemblymember representing San Francisco. "And we tried to reach out to EDD. Didn't get a response, or we heard that EDD was telling folks to just get rid of the letters or to mail them back to EDD – just answers that didn't make any sense to us."

Some homeowners told police that others had shown up at their homes to demand the mail. Burglaries of homes and robberies of postal inspectors over EDD envelopes followed.

In this chapter of Easy Money

- How we got here: Stories of gridlock and confusion after California closed businesses in March 2020 and sent unemployment numbers soaring. EDD's systems crashed and people needing unemployment relief couldn't get answers about their delays.

- Police and lawmakers hear about letters from EDD sent to bogus addresses and face challenges getting answers from EDD.

- How Gov. Gavin Newsom reacts to early reports of widescale fraud.

- The brazen steps criminals take, including making a rap video showing how easy it is to get money from EDD.

Watch Chapter 1 below:

A timeline of EDD's growing backlog and dysfunction

Some of EDD's problems predate the unprecedented COVID-19 pandemic and went unaddressed after previous audits, dating all the way back to at least 2008. After March 2020, a backlog of unemployment claims dovetailed with a rise in fraudulent claims. See KCRA 3's coverage of a series of missteps month by month in a timeline below.

Chapter 2: How the PUA Crime Unfolds

Cybersecurity expert Parker Crucq says that whenever there’s a big event happening in the world “we can expect criminals to capitalize on that event.”

In April 2020, California launched a new website for people to apply for pandemic unemployment assistance (PUA), allowing those who were self-employed or independent contractors to get assistance.

Tutorials began to pop up on the dark web on how to file a fraudulent PUA claim through a state’s unemployment website.

Click the slideshow below for an illustration of the basic EDD fraud scheme.

To make getting unemployment relief faster for those needing benefits, the state of California contracted with Bank of America to provide EDD debit cards. But those cards lacked anti-fraud chip technology or limits on how much cash could be withdrawn at once.

PUA fraud became so easy it became its own search term on criminal message boards.

Soon, surveillance video in Torrance would capture people feeding card after card into ATM machines at the town's two main banks.

District attorneys across California formed an EDD task force to investigate reports of fraud. It uncovered that people incarcerated at every prison and jail in California were collecting unemployment.

At one jail in El Dorado County, half of the people incarcerated there were collecting benefits, District Attorney Vern Pierson said.

Sacramento County District Attorney Anne Marie Schubert was shocked to see claims taken out under the names of "Minnie Mouse" and "Poopy Britches." Convicted killers Scott Peterson and Cary Stayner had claims taken out in their names, too.

Back in Southern California, 44 people were arrested with envelopes and debit cards in a September 2020 Beverly Hills fraud bust. In Torrance, detectives needed a U-Haul truck to hold a refrigerator, washer and dryer, laptops, tablets and more gear recovered from one suspect (see pictures of what was recovered in the gallery below).

1 of 7

PHOTO: Torrance PD

2 of 7

PHOTO: Torrance PD

3 of 7

PHOTO: Torrance PD

4 of 7

PHOTO: Torrance PD

5 of 7

PHOTO: Torrance PD

6 of 7

PHOTO: Torrance PD

7 of 7

PHOTO: Torrance PD

Some new customers flush with cash rented flashy cars to hit up Rodeo Drive for Gucci bags and $125 slippers imported from Paris.

"The traffic was insane," recalled Kitson boutique owner Fraser Ross. "The rentals were hot. You could see more Rolls Royces in LA all of a sudden."

"The bad guys knew about it. It's easy money," said Elk Grove Assemblymember Jim Cooper. "I'm not robbing a bank or robbing a store. I'm not stealing drugs. This is white-collar crime."

Police would go on to make arrests of accused EDD fraud ring leaders up and down the state.

Meanwhile, police departments and DAs started seeing what they call a "concerning" trend where EDD money was being used to fund drugs, ghost guns and human trafficking.

At a tense oversight hearing in October 2020, Southern California Assemblymember Rudy Salas asked then EDD Director Sharon Hilliard if she knew how much taxpayer money had been lost to widespread unemployment fraud.

"No, that's not something that we track," Hilliard said.

Assemblymember Chiu told Hilliard criminal rings were "stealing tens of thousands of people's identities" and her department had been "silent."

"You're saying you don't want to tell fraudsters how to do their job but they're already doing their job," he said. "But you're not warning the public on the level of fraud. You're giving no details on the types of crimes being committed against people so that people can be aware of what to look out for."

On Oct. 30, 2020, Hilliard announced her retirement. She left her post as director on Dec. 31, 2020, and was replaced by Rita Saenz.

In this chapter of Easy Money:

- A cybersecurity expert shows how stolen identities are bought and sold on the dark web.

- An LA boutique owner describes seeing people with wads of cash and cards hit up stores like they'd "just won the lottery."

- Hear jail conversations about how easy it was to get fraudulent claims.

- State lawmakers ask why EDD isn't sounding the alarm on fraud and call for an emergency audit.

Watch Chapter 2 below:

Think you have a handle on how EDD fraud works now? Take this interactive quiz. The answers might surprise you.

(App users, click here to take an interactive quiz about how EDD fraud works)

Chapter 3: A Cascade of Errors

Assemblymember Patterson jokes that nothing moves bureaucracies faster than having Elaine Howle down their back.

Howle has served for two decades as California's auditor, providing oversight of state agencies.

In September 2020, 40 members of California's Assembly and seven state senators signed on to an emergency audit request of EDD.

It wasn't the first time Howle would pinpoint problems for EDD to fix. Problems flagged by her office date back to 2008. In 2011, her report found issues with EDD's call center operations. A follow-up the next year "identified the same problems."

Howle's office decided on two separate audits this time, one dealing with concerns about people having difficulties with their claims and another dealing with identity theft and fraud.

| RELATED | Read the state auditor's two January 2021 reports with recommendations for EDD here

Howle found that in April and May of 2020 the federal government had sent out a warning about the need "to keep certain controls in place."

"So you would think you would have put a lot of resources on that and really thought through and worked with the federal government," Howle said. "OK, here are the requirements for the program. What are the kinds of controls we can or should put in place to try to mitigate fraud as much as we possibly can?"

Back in 2013, EDD had received a federal grant for new fraud-detection software by a Gold River company called Pondera Systems. The program compares public databases to see if applications are true or fraudulent.

One former EDD employee told KCRA 3 Investigates it detected "an amazing amount of fraud."

But by the summer of 2016, EDD decided not to pay the roughly $2 million a year to continue using the system after the grant funding ran out and EDD shut the Pondera system off.

Howle pointed to another misstep over crossmatching unemployment claims with the names of incarcerated people across the state.

EDD had told the Legislature long before the pandemic about its plan to cross-check fraud but "never got around to accomplishing it," she said.

Meanwhile, victims of identity fraud began to receive tax forms for income they never received.

Modesto Rep. Josh Harder said his office worked to help 3,500 people facing the issue.

"The IRS needs a list of who actually legitimately got EDD benefits," he said.

In this chapter of Easy Money:

- Learn about the fraud-catching system that EDD abandoned.

- Auditor Howle talks about EDD's history of problems and says that unemployment fraud across the country is "the most significant fraud occurrence that has happened for the United States."

- Identity theft victims begin to receive tax bills for money they never received.

- EDD's new director, Rita Saenz, agrees that people should be "pissed off" over her agency's screw-ups.

Watch Chapter 3 below:

What could you buy with $20 billion? Here's a start

Unemployed Californians struggled to get money for legitimate claims, all while the EDD paid out more than $20 billion to fraudulent accounts. Here's what you could buy with all that money.

Chapter 4: The Aftermath

In late July 2020, former federal prosecutor McGregor Scott was hired by the governor's office and EDD to help solve the agency's problems. Scott is not an employee. He has a unique position as an "independent counsel" as part of a Sacramento law firm.

"Grifters and fraudsters are out there looking for any weakness," he said. "And unfortunately, they identified a lot of weaknesses in the EDD process in terms of distributing money, and they took full advantage."

New safeguards like ID.me, an identity verification system used by other government agencies, have helped to stop fraud from taking place, he said.

In an irony, EDD hired the same company whose software they shut off – Pondera Solutions, now owned by Thomson Reuters – to partially help with fraud monitoring.

Another issue Scott said he's worked to address is EDD's delays in processing search warrants and other requests from law enforcement.

Riverside Det. Money said that EDD was taking several months to deliver records that would help him crack down on fraud.

EDD has since created a memorandum of understanding that a law enforcement agency can sign with EDD to go directly to the agency for needed documents.

Still, investigators and district attorneys say the EDD debacle has consumed their resources.

In Sacramento County, a person working full-time on EDD fraud could "spend the rest of their career probably doing these cases," District Attorney Schubert said. Law enforcement investigators said they spent 85% of their time working EDD cases at the expense of other crimes.

At the Capitol, lawmakers passed a sweeping set of bills to change EDD's practices.

Of the 10 bills written in that legislative session, four would make it into law. In October 2021, Newsom signed into law a requirement that California's prison system share information with EDD to cross-check for claims and that EDD help identity theft victims.

| RELATED | See an update from Auditor Howle from Oct. 25, 2021, that grades EDD on how well the agency has complied with her recommendations.

At a hearing earlier in the year, EDD's Saenz was asked how many people were fired for substandard job performance since she became director.

Saenz said she didn't know but added, "I don't have any sense that it's an unusual amount."

"I mean, we're talking 12 years in one instance, with the recommendations from the auditor, they ignored that this is going to help you and help your department and then you ignore it," Assemblymember Cooper said. "And it just didn't sit well with me. It doesn't sit well today, and it shouldn't with the citizens."

In this chapter of Easy Money:

- Former federal prosecutor McGregor Scott is brought in to fix problems at EDD and talks about his role and progress that's been made.

- How identity thieves skim information off EDD cards' magnetic strips.

- Why asset forfeiture law makes it hard to recover cash and goods bought with fraudulent EDD money.

- The estimates of the total fraud come into focus — and why the true cost is so hard to trace.

- Is there hope that EDD will be reformed?

Watch Chapter 4 below:

Chapter 5: The New Wave

Mike Holm was in the hospital for nearly a month and spent another month in a nursing care facility after getting a diabetic ulcer on his foot.

The junior varsity football coach at Whitney High School in Rocklin had gone on disability like hundreds of thousands of other Californians. It started well.

"I ended up receiving four checks," Holm said. "Then everything was just cut off."

He was caught in what Sacramento County District Attorney Schubert called “a new wave of EDD fraud.”

“The thievery will never go away. They're just going to try to change it up,” Schubert said.

In January 2022, EDD suspended 345,000 disability claims as the agency worked to verify the identity of about 27,000 doctors whose credentials were used to file the claims for purported patients.

Holm and others with disabilities called EDD to try to unfreeze their claims. When that didn’t work they emailed their elected representatives and in some cases waited in line for hours outside EDD offices.

In this chapter of Easy Money:

- Offices of lawmakers are inundated with calls from people with legitimate claims who are cut off.

- People travel to EDD offices that are far from home and still have trouble getting answers.

- Like the first wave of pandemic fraud that hit EDD, letters begin to show up in more mailboxes in the names of people who never filed claims.

Watch Chapter 5 below:

Chapter 6: The Middle Ages

As EDD grappled with the new wave of disability fraud, Director Saenz was moving on.

Gov. Newsom announced in January 2022 that Saenz was out and Nancy Farias, a chief deputy director, would become EDD’s third director since the pandemic began.

Meanwhile, EDD officials say at a budget hearing that the fraud unit recommended by the state’s auditor is “fully staffed and operational.”

“They had like a dozen peace officers to cover the whole state of California 40 million people,” Assemblymember Cooper says. “So really, the folks that have done the most in this, EDD fraud have been local law enforcement, your deputy sheriffs and police officers have done most of the investigations, most of the search warrants.”

One of the issues law enforcement has faced is a difficulty in seizing assets bought from fraudulent accounts. Under California law, it's harder to take the materials unless it’s that it was bought with illegally obtained money.

After the first four chapters of our “Easy Money” documentary were released, Cooper announces on a KCRA Facebook Live that he’ll introduce a new bill to allow law enforcement to seize those assets. But he’s skeptical that it will advance out of committee.

Another lawmaker, Assemblymember Patterson, thinks that he and other lawmakers who have sounded the alarm on EDD fraud have been having an effect.

“Those of us who have been elected to represent the constituents that are supposed to be served by the EDD, we have forced them to try at least to do a better job,” he said. “And maybe we're coming out of the dark ages of the EDD and maybe into the middle ages of the of the EDD. I don't know.”

In this chapter of Easy Money:

EDD’s latest director takes the helm as the agency works to implement recommendations from the state auditor.

Assemblymember Cooper introduces a new bill to change asset forfeiture law. But will the bill advance out of committee?

Watch Chapter 6 below:

Gov. Newsom responds to KCRA 3's questions about EDD fraud

Since the summer of 2021, KCRA 3 has asked Gov. Gavin Newsom to go on camera to talk about the massive fraud that hit EDD. With no response from the governor, "Easy Money" producer Dave Manoucheri attended the announcement of the state's revised budget in May 2022. See the governor's responses to some of the questions raised in the documentary here.

Moving forward: How to protect yourself from fraud

One of the most common ways criminals were able to take information from EDD debit cards was through a technology that has been around for quite some time: card skimmers.

Card skimmers are normally used at places like gas stations, which see several customers over short periods of time. See how they work in the video below.

Before you put your card in at gas stations — where card skimmers are most common — make sure the gas pump panel shows no signs of tampering. Then take a good look at the card reader itself, making sure it looks normal. If something seems off, wiggle the card reader and if it moves, let the attendant know.

When possible, run debit cards as credit so you don't have to put in a PIN. If this can't be avoided, cover your PIN with your hand so possible cameras nearby can't see what numbers are being typed in.

Never leave your credit or debit card out of sight either, and only take it out when you're about to use it.

Experts say that people should also keep any electronics like phones, tablets and computers up to date with the latest software updates to help protect against any vulnerabilities.

Also, familiarize yourself with the red flags that accompany scams. Be wary of emails, text messages, phone calls and letters from people you do not know. More importantly, never send money — whether it be cash, check or gift cards — to strangers or anyone pressuring you to send funds.

This digital presentation was written and produced by Hilda Flores and Daniel Macht.